Finance

Understanding Bitcoin Price: Trends, Analysis, and Future Predictions

Bitcoin is a decentralized digital currency introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. It is distinguished by its innovative use of blockchain technology, which enables secure and transparent transactions without the need for a central authority. This characteristic of decentralization has fundamentally altered the landscape of financial transactions, posing a challenge to traditional banking systems and financial institutions.

The significance of Bitcoin extends beyond its role as a medium of exchange. It serves as an emergent asset class, attracting attention from both retail and institutional investors. Since its inception, Bitcoin’s price has experienced significant volatility, often spurred by market demand, regulatory news, and advancements in technology. As a result, Bitcoin has garnered a reputation as “digital gold,” suggesting its potential to serve as a store of value and a hedge against inflation.

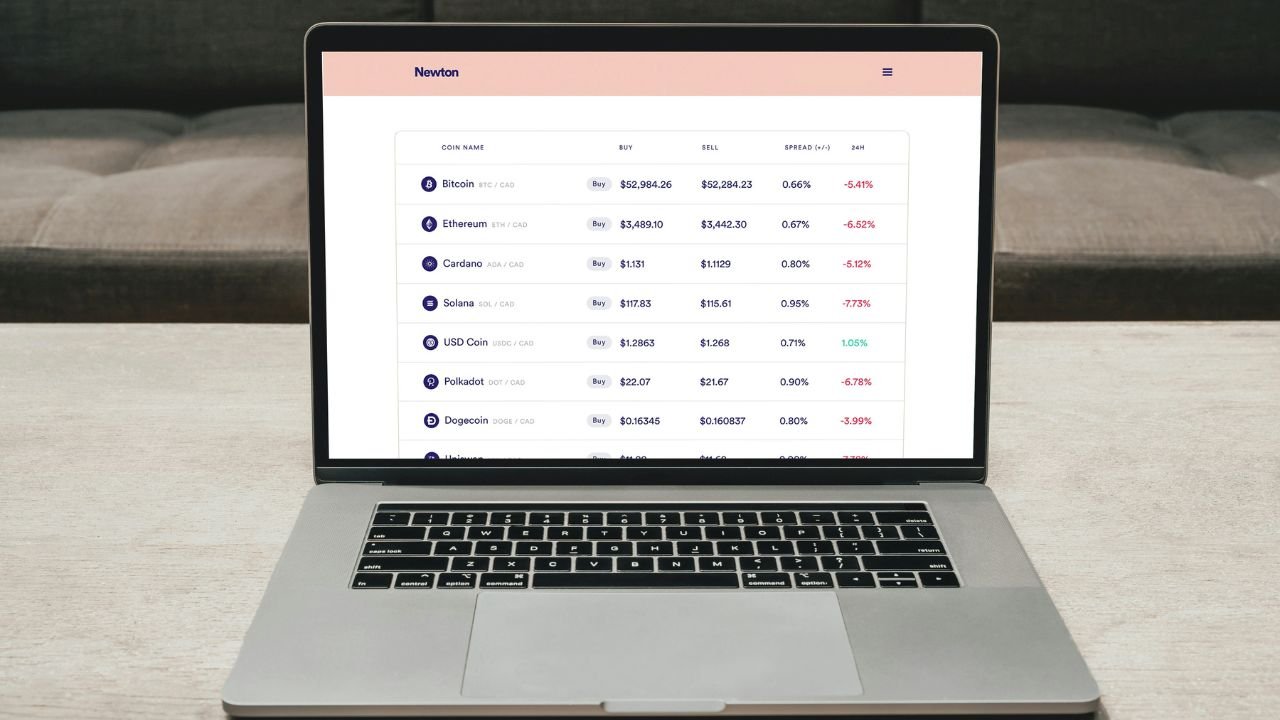

In recent years, Bitcoin has gained further prominence due to the increasing public interest in cryptocurrencies and their potential impact on the global economy. Its appeal lies in the promise of high returns and the opportunity to participate in a new financial paradigm. Major corporations and institutional investors have started to embrace Bitcoin, incorporating it into their portfolios as a strategic asset. This acceptance has further legitimized the asset and propelled its growth, making it a focal point in discussions surrounding financial innovation and the future of finance.

As Bitcoin continues to evolve, its implications for the global financial system remain profound. The currency’s ability to function independently of traditional financial systems presents both opportunities and challenges. Understanding Bitcoin’s origins, characteristics, and the factors influencing its price trends is essential for those seeking to navigate this complex landscape effectively.

Historical Price Trends of Bitcoin

The price of Bitcoin has experienced significant fluctuations since its inception in 2009, presenting a compelling case study for investors and analysts alike. Initially, Bitcoin was valued at merely a few cents when it was first traded, but it catapulted to new heights in subsequent years, reaching a peak value of nearly $65,000 in April 2021. This dramatic rise can be attributed to several key milestones and market dynamics.

One of the earliest notable price movements occurred in 2011 when Bitcoin reached the $1 mark for the first time, catalyzing curiosity and interest in the cryptocurrency. Soon after, a notable rally pushed its value to over $31, only to face a significant crash, dropping to approximately $2. These early price changes illustrated the volatility that would become characteristic of Bitcoin.

2017 marked another pivotal year, as Bitcoin surged to approximately $20,000 in December amid growing public awareness and media coverage. This spike depicted not just investor enthusiasm but also the influence of global events, such as increased regulatory discussions and the emergence of Initial Coin Offerings (ICOs). Subsequently, Bitcoin faced another downturn, entering a bear market that saw prices decrease to around $3,000 by late 2018. Such patterns reveal the relationship between market sentiment and Bitcoin’s price.

The pandemic in 2020 acted as a catalyst, with many global investors turning to Bitcoin as a hedge against traditional market volatility. The price soared once again, influenced by institutional adoption and increased acceptance by major companies. Understanding these historical price trends of Bitcoin is essential for grasping its future potential and ongoing evolution in the global financial market. The interplay between technological advancements, regulatory changes, and macroeconomic factors will undoubtedly shape Bitcoin’s trajectory going forward.

Factors Influencing Bitcoin Price

The price of Bitcoin, the pioneering cryptocurrency, is influenced by a multitude of factors that create a complex landscape of volatility and unpredictability. At the core of Bitcoin pricing dynamics lies the law of supply and demand. As demand for Bitcoin increases, often driven by investor interest and media coverage, the price naturally rises, particularly when the supply is limited. The maximum supply of Bitcoin is capped at 21 million coins, and this scarcity can intensify price surges, particularly during bullish market trends.

Regulatory developments also play a crucial role in shaping Bitcoin’s market value. Regulatory bodies across the globe are continuously assessing how to manage and oversee cryptocurrencies. Positive regulations can lead to increased institutional investment, enhancing credibility and subsequently lifting prices. Conversely, stringent regulations or outright bans can cause panic selling, which typically results in significant price declines. The regulatory environment remains a key aspect for both investors and traders to monitor closely.

Technological advancements within the ecosystem also significantly influence Bitcoin’s valuation. Improvements such as upgrades in blockchain technology, enhanced security measures, and implementation of scaling solutions can make transactions more efficient, encouraging broader usage and acceptance. Additionally, developments in interoperability with other systems can further drive demand for Bitcoin and indirectly impact its price.

Finally, macroeconomic factors, such as inflation rates, economic stability, and shifts in monetary policies, also contribute to Bitcoin’s volatility. During times of economic uncertainty, investors may turn to Bitcoin as a hedge against traditional financial systems, leading to price increases. Collectively, these factors create a dynamic and often unpredictable market, underscoring the importance of thorough analysis when considering investments in Bitcoin.

Bitcoin Price Analysis Techniques

Analyzing Bitcoin price movements requires a comprehensive approach, integrating various methodologies to obtain a well-rounded understanding of market dynamics. Among the predominant techniques employed in Bitcoin analysis are fundamental analysis, technical analysis, and sentiment analysis. Each method offers unique insights that can guide traders and investors in making informed decisions.

Fundamental analysis focuses on assessing the intrinsic value of Bitcoin. This entails evaluating various factors that can affect its price, such as market demand, regulatory developments, macroeconomic indicators, and technological advancements. Investors utilizing this technique often consider Bitcoin’s supply and demand dynamics, such as its halving events and the emergence of competing cryptocurrencies. By analyzing these fundamental aspects, traders can form an understanding of Bitcoin’s long-term potential and the factors that might influence price changes.

In contrast, technical analysis relies on historical price data and market trends to forecast future price movements. Traders employing this methodology examine charts and utilize various indicators—such as moving averages, Relative Strength Index (RSI), and trading volume—to identify patterns and trends. Technical analysis helps detect trends in Bitcoin price fluctuations, allowing traders to make short-term decisions based on price action and market psychology. This approach can be particularly beneficial in a market as volatile as that of cryptocurrencies.

Lastly, sentiment analysis involves gauging the market’s overall mood towards Bitcoin. This can be assessed through various channels, including news articles, social media discussions, and broader market trends. By understanding public sentiment, traders can anticipate potential market movements. For instance, an overwhelmingly positive sentiment might indicate a rally, while negative sentiment could signal a downturn. Integrating sentiment analysis with fundamental and technical analysis can provide a more robust framework for understanding Bitcoin price dynamics.

The Role of Market Sentiment and News in Bitcoin Pricing

Understanding the price fluctuations of Bitcoin requires not only technical analysis but also a thorough examination of market sentiment and news events. Public perception plays a significant role in the cryptocurrency’s pricing, whereby emotions and collective attitudes among investors can lead to dramatic shifts in value. For instance, during periods of bullish sentiment, the demand for Bitcoin often escalates, resulting in a surge in prices. Conversely, negative sentiment can trigger panic selling, leading to rapid declines.

Media coverage is another crucial factor in shaping public perception. Major news outlets holding either positive or negative biases can influence the broader audience’s view of Bitcoin. Reports on regulatory developments, security breaches, or endorsements from influential figures can sway investor sentiment significantly. When major entities announce their support for Bitcoin, it often leads to increased interest in the cryptocurrency, manifesting in rising prices. Similarly, dire news regarding related technologies or platforms can deter new investors and trigger sell-offs, which further drives down Bitcoin values.

The psychology of market participants also plays an essential role in determining Bitcoin’s price. Events such as regulatory announcements have shown the power to sway investor behavior drastically. A favorable regulatory framework can evoke optimism and encourage adoption, leading to a price surge. On the other hand, restrictive regulations can foster fear and uncertainty, causing hesitation among investors. Institutional adoption is also a potent driver; when large firms announce their investment in Bitcoin, it can send a signal of legitimacy, often resulting in increased retail participation and investment.

Ultimately, the interplay between market sentiment and news highlights the volatility inherent in Bitcoin pricing. These elements demonstrate how human emotions and societal developments can have palpable effects on the cryptocurrency market, underscoring the importance of continual monitoring of news trends and public sentiment for anyone looking to understand Bitcoin’s price movements.

Impact of Institutional Investment on Bitcoin Price

The influence of institutional investment on Bitcoin’s price has become increasingly significant in recent years. As traditional financial entities such as hedge funds, pension funds, and asset management firms begin to allocate capital towards Bitcoin, the dynamics of its market are evolving. This shift not only brings a surge of liquidity into the cryptocurrency space but also lends legitimacy to Bitcoin as a viable asset class. Notably, investments from institutions like MicroStrategy and Tesla have highlighted the commitment of large-scale players to Bitcoin, contributing to its price volatility and growth.

One of the major implications of institutional involvement is the stability it may bring to the Bitcoin market. With large amounts of capital entering the ecosystem, the price can become less susceptible to the whims of retail investor sentiment, which has historically caused significant fluctuations. Institutions often employ more strategic risk management techniques, which could cushion against severe market downturns. Additionally, their research-backed approach allows for a more measured outlook toward investing in Bitcoin, potentially leading to improved market confidence among other investors.

Furthermore, as institutions gain exposure to Bitcoin, they often seek to diversify their holdings within the cryptocurrency sector, which may attract further institutional participation. This cycle can create greater demand and, subsequently, upward pressure on prices. As awareness grows and products tailored for institutional investors, such as Bitcoin ETFs, gain regulatory approval, the landscape for Bitcoin could shift dramatically. By providing pathways for institutional entry and increasing trust in Bitcoin, these developments could herald a new era for its price dynamics.

Bitcoin Compared to Traditional Assets

In recent years, Bitcoin has emerged as a prominent investment vehicle, capturing the attention of both retail and institutional investors. When analyzing Bitcoin’s price performance in comparison to traditional assets such as gold, stocks, and real estate, several unique characteristics come to the forefront. Unlike physical assets, Bitcoin is a digital currency that operates on a decentralized network, which allows for characteristics such as portability and divisibility. These factors contribute to its appeal as a modern store of value.

Gold, long regarded as a safe-haven asset, has history on its side, often serving as a hedge against inflation and economic uncertainties. However, Bitcoin has been increasingly viewed through a similar lens, emerging as a digital counterpart to gold. Both assets are subject to market dynamics and investor sentiment; yet, their price movements can differ significantly. During periods of financial instability, gold typically provides stability, while Bitcoin has exhibited greater volatility, making it both risky and potentially rewarding for investors.

When compared to the stock market, Bitcoin’s price action often diverges. Traditional stocks are influenced by factors such as earnings reports, economic indicators, and corporate performance. Conversely, Bitcoin’s price is impacted by its own set of dynamics, including regulatory news, blockchain technology developments, and large-scale market buy or sell activities. This can lead to periods where Bitcoin’s performance becomes uncorrelated with traditional equities, acting as a diversifier in a broader portfolio.

Moreover, real estate as an asset class tends to provide stable returns over time, with fluctuations largely tied to local economic conditions and interest rates. On the other hand, Bitcoin’s prices can experience abrupt swings in a short timeframe, influenced by speculative trading and changing investor perceptions. Hence, while traditional assets offer reliability and predictability, Bitcoin represents a novel investment opportunity characterized by its digital nature and market behavior.

Future Predictions for Bitcoin Price

As Bitcoin continues to gain prominence as a digital asset, financial experts have developed various predictions regarding its future price trajectory. In recent years, Bitcoin’s volatility has elicited a wide range of opinions, with some market analysts projecting bullish scenarios while others advocate caution and predict bearish outcomes. A crucial factor influencing these predictions is macroeconomic indicators, regulatory developments, and the overall adoption of cryptocurrencies.

Many analysts adopt a bullish outlook on Bitcoin, suggesting that increased institutional adoption and mainstream integration of blockchain technology could lead to a price surge. For instance, prominent investors such as Cathie Wood of ARK Invest have suggested that Bitcoin could reach $500,000 per coin over the next decade, citing its potential as a hedge against inflation and a store of value akin to gold. This perspective emphasizes Bitcoin’s rarity and deflationary qualities, which could drive demand as fiat currencies undergo devaluation.

Conversely, some experts remain skeptical about Bitcoin’s long-term sustainability. They argue that potential regulatory crackdowns, market manipulation, and competition from emerging cryptocurrencies could pose significant risks to Bitcoin’s price. Notable predictions highlight a significant drop should investor sentiment shift negatively or if economic conditions deteriorate. Analysts projecting bearish trends see potential price corrections that could bring Bitcoin below the critical psychological level of $20,000, depending on the regulatory landscape and market psychology.

In conclusion, the future of Bitcoin’s price remains uncertain and highly contentious. The prevailing views among market experts showcase a variety of potential scenarios, driven largely by external economic factors and evolving market sentiments. Stakeholders in the cryptocurrency ecosystem must stay informed about these trends and utilize analytical insights to navigate this complex landscape effectively.

Conclusion: Understanding Bitcoin’s Volatility and Potential

In reviewing the trends, analysis, and future predictions surrounding Bitcoin’s price, it is evident that this cryptocurrency remains a complex and dynamic asset. Bitcoin’s inherent volatility is a significant characteristic that influences its market performance, making it both an attractive and risky investment for individuals and institutions alike. Price fluctuations can be attributed to various factors, including market sentiment, regulatory developments, technological advancements, and macroeconomic trends. Understanding these elements is crucial for any stakeholder engaged in the cryptocurrency market.

Despite the volatility, Bitcoin continues to show potential for growth. As more people and businesses adopt cryptocurrency, the demand for Bitcoin could rise, contributing to its value appreciation over time. Furthermore, developments such as potential regulatory clarity, increased institutional investment, and technological improvements, like the integration of Bitcoin into traditional financial systems, may provide a conducive environment for Bitcoin’s price stability in the future. On the other hand, investors should remain vigilant, as unforeseen events and shifts in regulatory frameworks can quickly alter the market landscape.

The necessity for informed decision-making cannot be overstated when navigating the cryptocurrency space. Investors and enthusiasts should regularly engage in research to stay abreast of market movements, regulatory updates, and technological innovations. Awareness of Bitcoin’s volatility should guide investment strategies, emphasizing the importance of risk management and diversified portfolios. In essence, the future outlook for Bitcoin remains an evolving narrative shaped by numerous variables, necessitating continuous scrutiny and understanding from all market participants.